About Us

Athabasca Oil Corporation ("AOC") is a liquids-weighted intermediate producer involved in the development of Canada's most active resource plays (Montney, Duvernay, Oil Sands). We offer investors excellent exposure to oil prices and are focused on maximizing profitability through prudent capital activity across a diversified asset base.

Our strategy is guided by:

Our strategy is intended to ensure both Light Oil and Thermal Oil are financially robust and competitive, with exceptional future growth opportunities. Our strategic emphasis is to maximize shareholder returns by achieving top tier margins across the business and generating free cash flow into the future.

AOC's common shares trade on the Toronto Stock Exchange under the symbol ATH.

Why Own Athabasca?

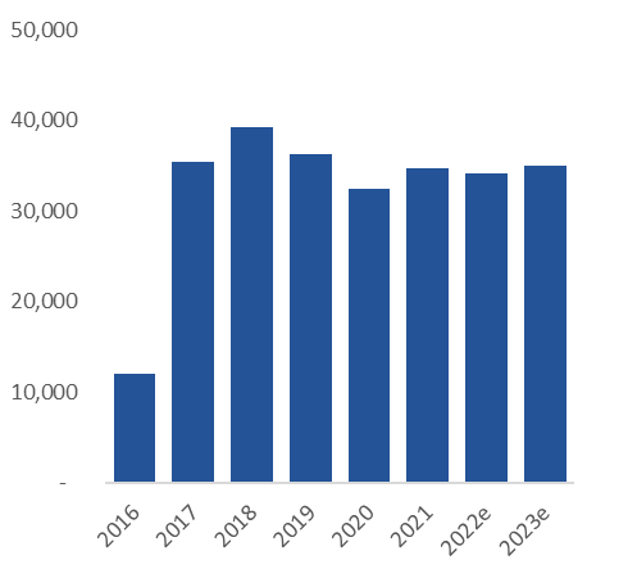

Predictable, Low Decline Thermal Oil Business

- Strong netbacks

- Low sustaining capital requirements

- >1 billion boe 2P reserves underpins long reserve life

De-risked Light Oil Business With Flexible Capital

- Strong netbacks

- Large inventory in the Montney & Duvernay; ~850 gross locations

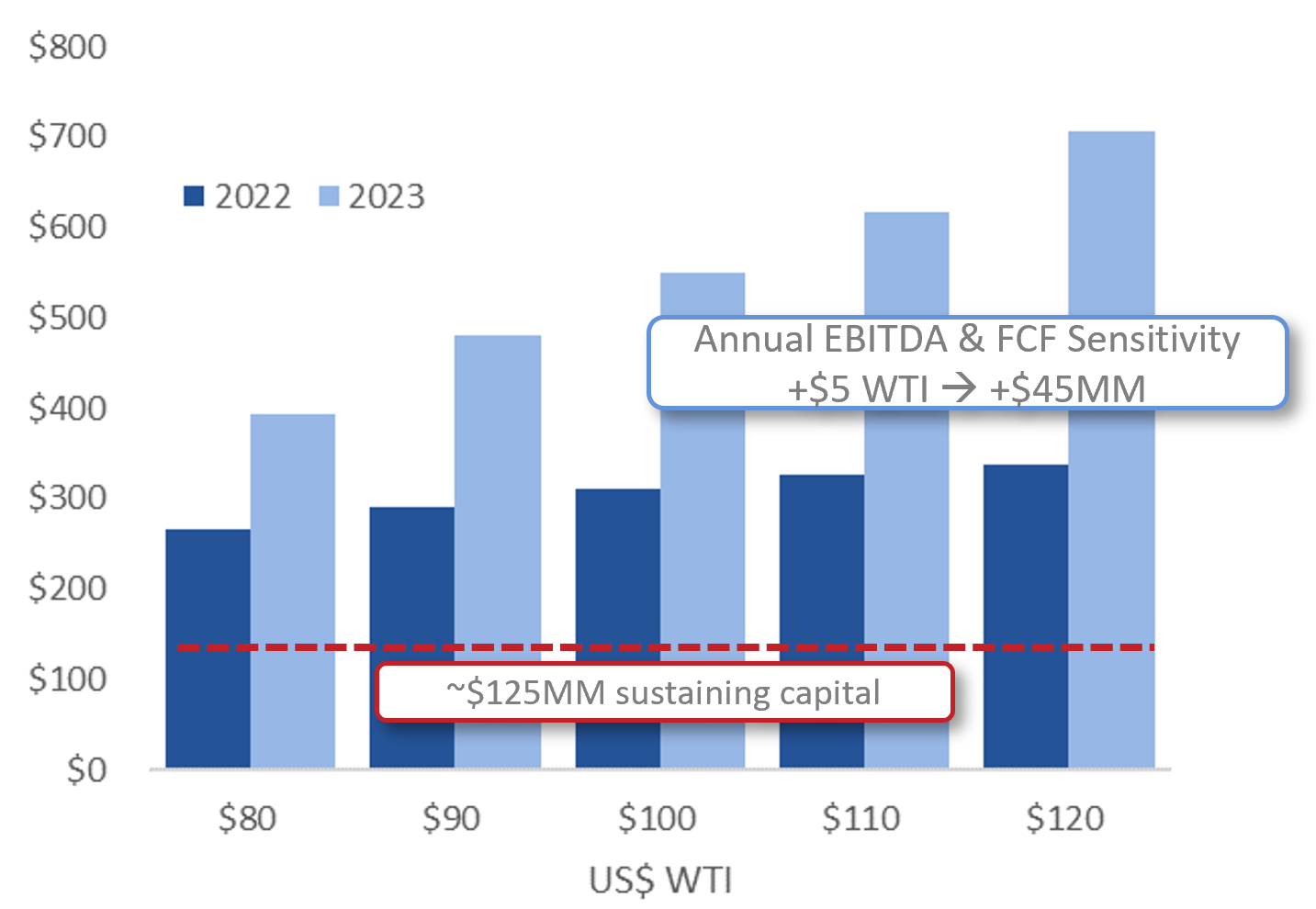

Strong Financial Capacity

- Low net debt

- Net cash by year end 2022; 100% of FCF to debt reduction near-term

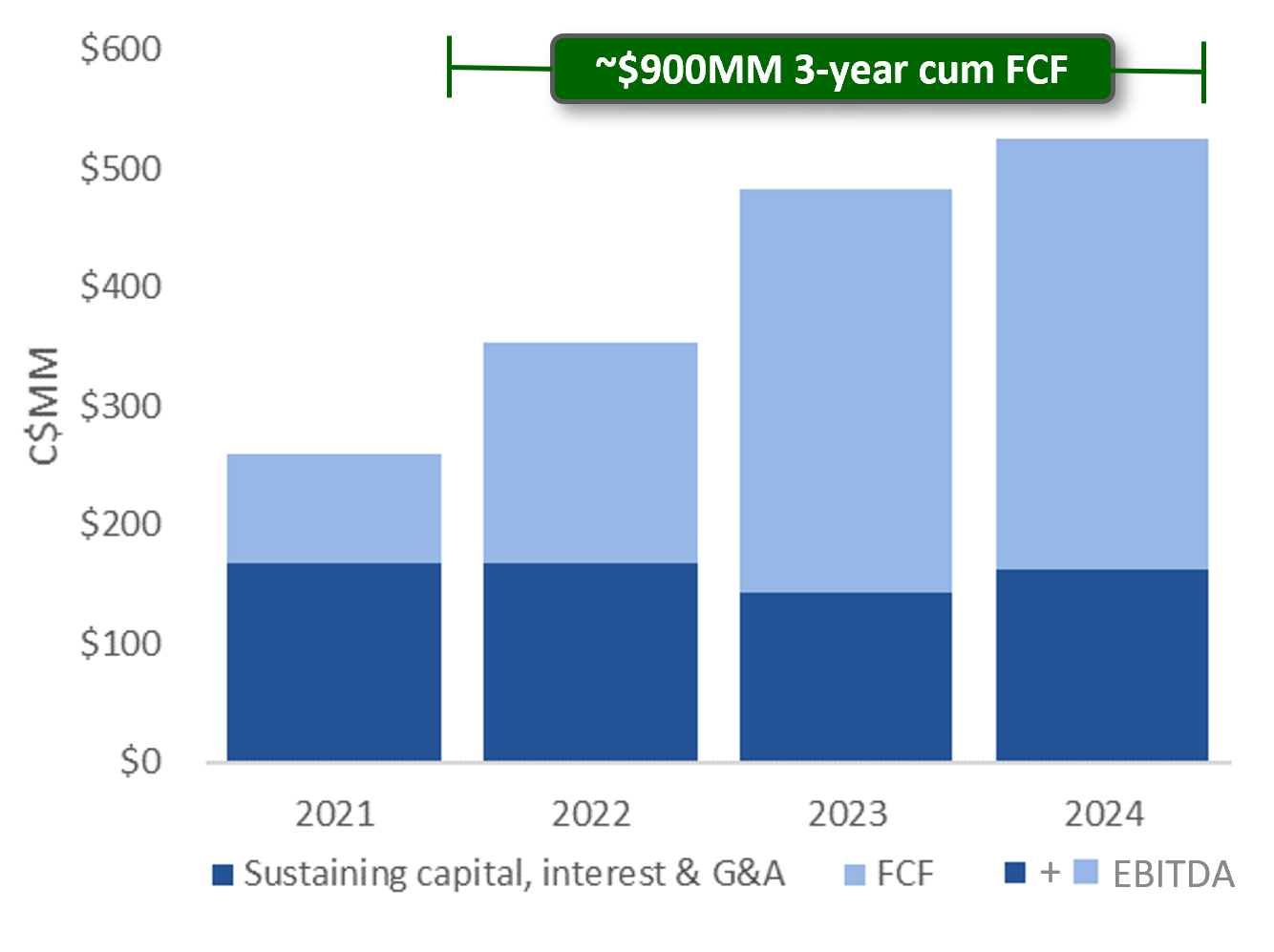

Managing for strong free cash flow

- ~$180MM FCF in 2022; ~$900MM over 2022-24 at US$85 WTI

- Net cash by year end 2022; 100% of FCF to debt reduction near-term

Integrated Sustainability

- Strong governance; Board oversight of ESG

- Committed to reducing emissions; advancing CCUS project with Entropy Inc.